la county tax collector auction

The tax collectors office is located in Municipal Hall 4233 Kennedy Blvd. The office will be open from 8 am.

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

The Treasurer and Tax Collector of Los Angeles County is offering 1148 parcels for auction online.

. COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR 500 WEST TEMPLE STREET 437 KENNETH HAHN HALL OF ADMINISTRATION LOS ANGELES CALIFORNIA 90012 TELEPHONE. This ten-digit AIN is made up of a four-digit Map Book Number 1234 a three-digit Page Number 567 and a three-digit Parcel Number 890. There is now a 24-hour drop box located in the Police Station for tax payments.

On March 15 2022 the LA. 101 Courthouse Square Ste. Turn right at Bixby Dr.

Tax-Defaulted Property Auctions 213 974-2045. The auction is located at the corner of Bixby Dr. The County is committed to the health and well-being of the public.

The Tax Collector Office is available Monday - Friday 900am-400pm if you have any questions regarding your payment history etc. 2005A TAX SALE PUBLIC AUCTION We are in the process of preparing for the upcoming 2005A tax sale that is scheduled for February 14 and 15 2005. These are all NO RESERVE auctions.

Bids start as low as 161300. Public auctions are the most common way of selling tax-defaulted property. Finance Investments 213 974-7175.

Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. And continue to Chestnut. In accordance with California law the Los Angeles County Tax Collector will commence the public auction of properties for which the taxes interest and fees have not been paid and continues from day to day until each property is sold to satisfy the taxes.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Borough of Roselle Tax Collectors Office 210 Chestnut Street 2nd Floor Roselle NJ 07203. Real Property Public Works The Public Works Department provides descriptions and photos of surplus property it auctions.

Business License 213 9742011. Tax Sale on Sept. Real Property Treasurer and Tax Collector.

These are all NO RESERVE auctions. The tax collectors office will have extended hours on Wednesday Nov. Tax-Defaulted Property Chapter 8 213 974-0871.

Turn left onto E Gale Ave. I want the list of tax delinquent properties in LA County Please contact the LA County Treasurer Tax Collector at httpttclacountygovProptaxauction_generalInfohtm. The auction is conducted by the county tax collector and the property is sold to the highest bidder.

Real property from estates administered by the County are offered at auction about once a month normally the third Saturday and Sunday at the location of the site being sold. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and community colleges and special districts. Supervisor Gloria Molina Chair Supervisor Yvonne B.

Gonzales PCCTax Assessor Collector. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Excluding Los Angeles County holidays.

The Treasurer and Tax Collector of Los Angeles County is offering 163 parcels for auction online. Take the 60 Fwy east to the Azusa Ave exit and turn left onto S Azusa. The auction is located at the corner of Bixby Dr.

Contact the Los Angeles County Tax Collectors Office to verify the time and location of the Los Angeles County tax sale. Bids start as low as 142600. All property offered for sale if done so by Los Angeles County and comes from estates the County serves as Public Administrator or Public Guardian.

The payments are picked up from the box every business day at 900 AM and posted that same day. Extended Tax Collector Hours on Nov. We are accepting in-person online and mail-in property tax payments at this time.

Saladino Treasurer and Tax Colle SUBJECT. The Los Angeles County Treasurer and Tax Collector will conduct a public auction of tax-defaulted real property over a two-day period starting October 21 and 22 2019 from 900 am. Ad Foreclosure properties updated daily.

Read Less Read More. A single 5000 deposit plus a 35 non-refundable processing fee is required to participate in the Los Angeles County CA Tax Sale. The Los Angeles County Treasury and Tax Collector Public Administrator has designated CWS Asset Management Sales as the prime contractor for their personal property estate auctions.

Please mail tax payments to. Posted Friday November 5 2021. From Los Angeles 31 Minutes.

As we have previously advised your honorable Board this office will be conducting a public auction of tax-defaulted properties this coming Monday and Tuesday February 24-25 2003. County Board of Supervisors passed a motion by Supervisors Kathryn Barger and Janice Hahn to cancel property tax penalties interest costs and fees for property owners that have been negatively affected by the eviction moratorium passed by the Board as part of its COVID-19 relief efforts. The Los Angeles County Treasurer and Tax Collector TTC sells properties located in Los Angeles County due to defaulted property taxes exceeding five years or more for residential or agricultural property and three years or more for non-residential commercial property and vacant land.

Los Angeles County CA currently has 10338 tax liens available as of April 23. Assessee - The owner of record and the. A single 5000 deposit plus a 35 non-refundable processing fee is required to participate in the Los Angeles County CA Tax Sale.

The Assessors Identification Number AIN is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. 24-Hour Payment Drop Box Now Available. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Los Angeles County CA at tax lien auctions or online distressed asset sales.

For more information please click HERE You must register in advance to participate and bid. Collectively over one million secured unsecured supplemental and delinquent property tax bills. Collection Services 213 974-0160.

Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. Pursuant to California Revenue and Taxation Code RTC section 37005 the county tax collectors are required to notify the State Controllers Office not less than 45 days nor more than 120 days. Burke Supervisor Zev Yaroslavsky Supervisor Don Knabe Supervisor Michael D.

Pay Your Property Taxes Treasurer And Tax Collector

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Understanding California S Property Taxes

Los Angeles County Zoning Information Map Zimas Alternative Propertyshark Com

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Pay Property Tax Bill Online County Of Los Angeles Papergov

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Secured Property Taxes Treasurer Tax Collector

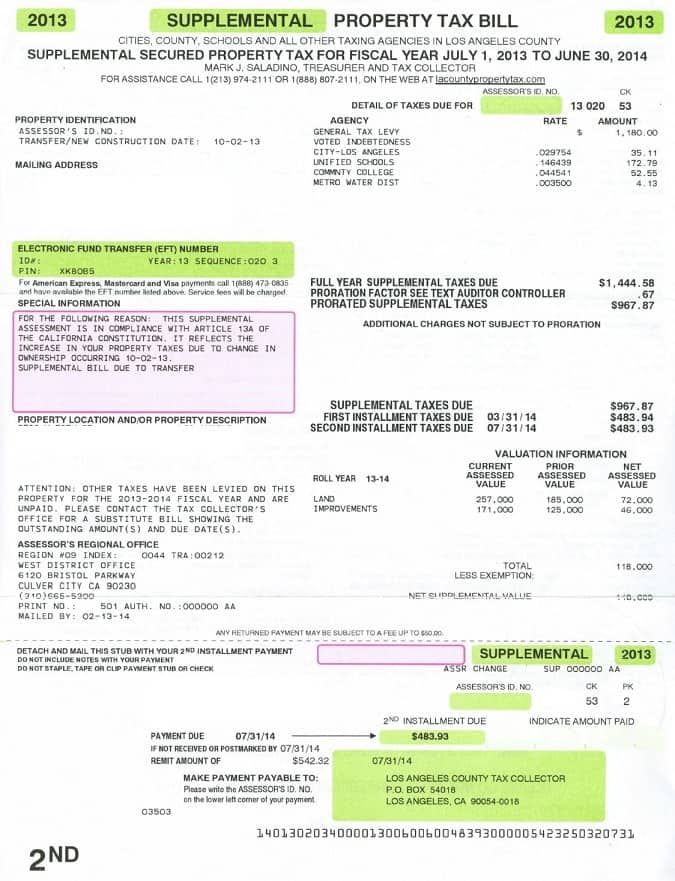

Los Angeles Supplemental Property Tax Bill James Campbell Los Angeles Real Estate Agent

Find La County Commercial Property Owners

Copy Of A Property Tax Bill For La County Property Tax Tax Los Angeles Real Estate